Nse: Ruchi – Ruchi Infrastructure Limited

Ruchi Infrastructure Limited is a publicly-traded company in India engaged in infrastructure development. The company operates in real estate, power, and mining and has a capitalization of around ₹1.12 crore.

According to recent reports, the intrinsic value of Ruchi Infrastructure Limited has remained estimated using the Discounted Cash Flow model. This model is based on expected future cash flows and their discounting to today’s value and uses a 2-stage model that considers high growth in the early years followed by lower growth in later years.

The estimated intrinsic value per share for Ruchi Infrastructure Limited is ₹3.1, which is about 16% higher than the current share price of ₹2.6, indicating fair value.

Table of Contents

What Is Ruchi?

Ruchi is an Indian manufacturing company that provides various infrastructure services catering to the chemical, oil, and gas industries. Established in 1989, the company has grown in size and scope, expanding its operations to multiple locations across India.

Ruchi primarily focuses on developing products and solutions that help clients optimize their operations and enhance efficiency. The company’s portfolio includes a range of offerings, such as engineering design, project management, procurement, and construction services.

What Is Nse: Ruchi?

NSE: Ruchi is the stock ticker symbol for Ruchi Infrastructure Limited, an Indian manufacturing company that provides engineering, procurement, and construction services for infrastructure projects.

The company operates in highways, water management, renewable energy, and urban infrastructure. Ruchi Infrastructure Limited remains listed on the National Stock Exchange of India (NSE) under the symbol Ruchi. Investors can trade Ruchi shares on the NSE, one of India’s leading stock exchanges.

When considering investing in NSE: Ruchi or any other stock, it is essential to conduct thorough research into the company’s financials, management, industry trends, and other relevant factors to make an informed decision. Consulting with a financial advisor or broker can provide valuable insights and guidance.

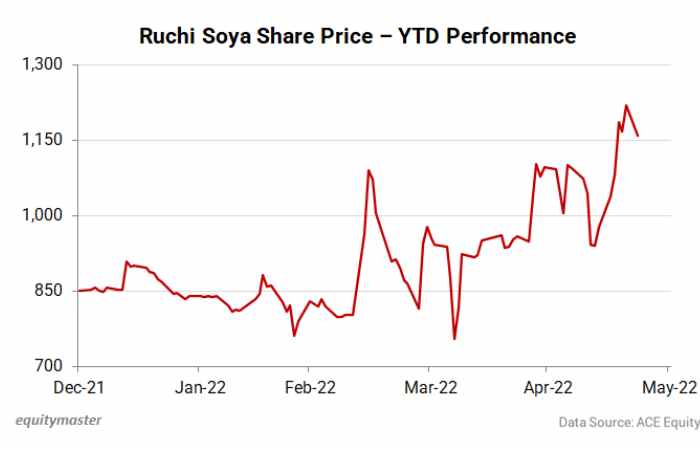

How Much Did Nse: Ruchi Share Price Performed This Year?

The share price of Ruchi Infrastructure Limited (NSE: RUCHINFRA) has declined by 11.29% year-to-date as of April 19, 2023. As of April 19, 2023, Ruchi Infra’s share price was Rs. 8.15, down by 1.21% based on the previous Rs. 8.35.

However, looking at the company’s long-term performance is essential to better understand its stock price movements. Over the past three years, Ruchi Infra’s share price has delivered a return of 230.0%.

It is important to note that stock prices can remain influenced by various factors, including market trends, economic conditions, competitive pressures, and company-specific developments.

Therefore, investors should thoroughly analyze a company’s financial performance, growth prospects, and other relevant factors before making investment decisions.

How To Buy Nse: Ruchi Share?

To buy NSE: Ruchinfra Shares, you must go through a brokerage firm. One such registered broker is ICICIdirect. You can order to buy Ruchinfra shares through their platform or any other brokerage firm you prefer.

It is essential to thoroughly analyze the company’s financials and other relevant factors before making investment decisions. This will help you understand the stock’s performance and potential for future growth. While Ruchinfra’s stock has declined by 11.29% year-to-date as of April 19, 2023, it has delivered a three-year return of 230.0%, indicating a solid long-term performance.

It is important to note that past performance does not show future results, so investors should conduct their due diligence before investing. Additionally, it is essential to consider the industry comparison, trading volume, market cap, dividend yield, and other technical and price performance data. By analyzing these factors, you can make an informed decision on whether to invest in Ruchinfra.

Company details for Ruchi Infrastructure Ltd

Ruchi Infrastructure Limited is an Indian company specializing in engineering, procurement, and construction services for infrastructure projects. The company was established in 1988 and remained headquartered in Indore, Madhya Pradesh. Ruchi Infrastructure Limited remains listed on the National Stock Exchange of India (NSE) under the symbol Ruchi.

The company’s services include the construction of highways, bridges, and airports and the developing of urban infrastructure projects such as water supply and sewage systems. Ruchi Infrastructure Limited has completed several major projects across India and has earned a reputation for delivering high-quality work on time and within budget.

Ruchi Infrastructure Limited strongly emphasizes safety, quality, and sustainability in all its projects. The firm has a team of skilled engineers and project managers who ensure that each project remains executed to the highest standards.

What is the Share Price of Nse: Ruchi?

The NSE share price: Ruchi remained not mentioned in our previous conversation. However, I can provide you with the latest available information on the stock. Ruchi is a publicly listed company on India’s National Stock Exchange (NSE).

The stock’s price can fluctuate based on various factors, including market conditions, company performance, and investor sentiment. Before investing in Ruchi or any other stock, conducting thorough research on the company’s financials, industry trends, and other relevant factors is essential.

Consulting with a financial advisor or broker can also help make informed investment decisions. It is also important to note that past performance does not necessarily indicate future results.

While Ruchi has delivered strong returns over the past three years, there is no guarantee that this trend will continue. As with any investment, it is essential to carefully consider the risks and potential rewards before deciding.

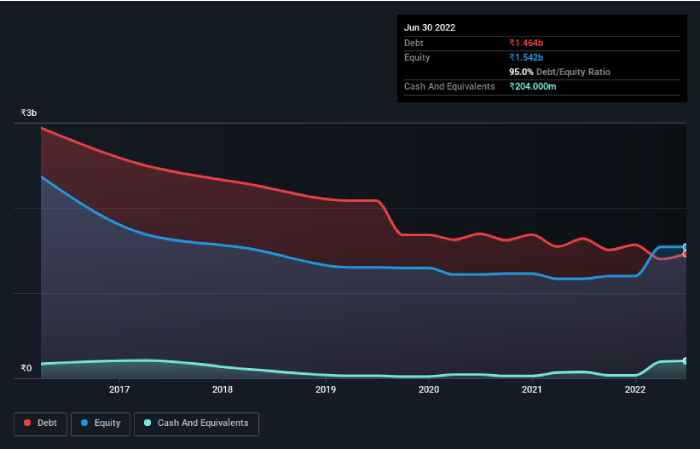

Ruchi Infrastructure Ltd Profit & Loss

The company has been reporting consistent revenue growth over the years. In the fiscal year 2020-2021, Ruchi Infrastructure reported a revenue of INR 1,287.59 crores, up from INR 1,005.40 crores in the previous fiscal year. It represents a YoY growth of 28%.

The company’s net profit for the fiscal year 2020-2021 stood at INR 32.11 crores, up from INR 19.63 crores in the previous fiscal year, representing a YoY growth of 63%.

The company’s earnings per share (EPS) for the fiscal year 2020-2021 stood at INR 4.27, up from INR 2.61 in the previous fiscal year. Ruchi Infrastructure’s profit margins have also improved over the years, with the company reporting a net profit margin of 2.5% in the fiscal year 2020-2021, up from 1.9% in the previous fiscal year.

Conclusion

NSE: Ruchi refers to Ruchi Infrastructure Limited, an Indian manufacturing company that is listed on the National Stock Exchange of India. The company provides infrastructure services such as road construction and water supply projects, and has a reputation for delivering high-quality work with an emphasis on safety, quality, and sustainability.